Back to school, cautiously

Article by John Wagner Jr from Wagner Logistics published on August 14th 2013

Whatever happened to the school year beginning after Labor Day? It is hard to believe the yellow buses are already taking the kids back to school. As you travel around, be sure to keep an eye out for children going to and from school.

As we head into the back-to-school season, the economy still inches forward and dodges the headwinds created by the government. The latest war of words in Washington has to do with the upcoming debt ceiling debate and the replacement for Chairman Bernanke at the Federal Reserve Bank. The heavy negative press is stoking fear in the markets, affecting consumer behavior.

The Federal Reserve is presently preparing the country (hinting in its own subtle way) that its $85 billion-per-month purchase of bonds could be curtailed as early as the September policy meeting. This could result in interest rates inching upward. The Fed will be watching unemployment, manufacturing, and economic growth to decide when to taper U.S. bond purchases but all indications point to that taking place this fall.

The Fed always watches consumer behavior as it makes up 70 percent of the economy, so Tuesday’s report from the Commerce Department should be of special interest. U.S. retail sales were up slightly, 0.2 percent from June to July, as auto sales fell 1 percent.

"Core" retail sales, which exclude auto, gasoline and building supplies, increased by 0.5 percent, the biggest increase since last December. At retail stores, sales jumped 0.6 percent with strong gains at personal goods and health stores. July sales were the strongest since March 2012.

Commerce also said that retail inventories dipped when autos were taken out of the mix, making analysts believe that the second-quarter GDP may be weaker than the 1.7 percent previously announced.

There is little inflationary pressure due to import pricing rising only 0.2 percent, signifying a big drop-off in non-gasoline-related products in four years.

The Commerce Department had previously announced that the United States trade gap shrank 22.4 percent in June to 34.2 billion from $44.1 billion in May. This is the lowest trade deficit since fall 2009.

The Labor Department reports mixed news on the job front. The pace of hiring has slowed. But, there are now 2.99 people for every available job opening, the lowest this figure has been since October 2008. First-time claims for unemployment have dropped to the lowest level in five years.

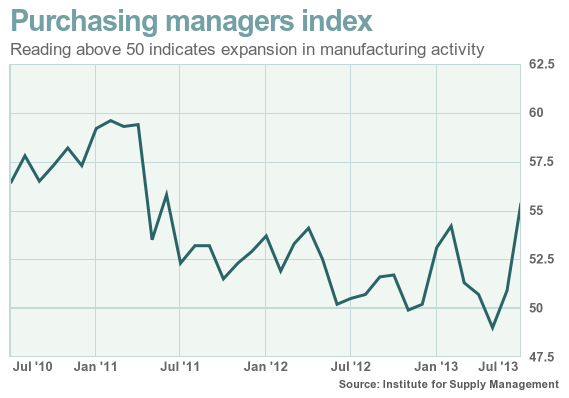

ISM Index shows promise

The Institute for Supply Management’s (ISM) factory index jumped to a reading of 55.4 in July from 50.9 in June, signifying increased orders and production.

Everyone is hoping that this is a display of more optimism on the part of the nation’s manufacturers about the direction for the U.S. economy. Any reading over 50 indicates expansion so this is good news, as manufacturing drives about 12 percent of the nation’s economy.

The ISM measures for the service sector improved, coming in at 56 for July, up from 52.2 in June. The ISM services index includes retail sales, transportation and other nonmanufacturing business. This sector accounts for almost two-thirds of the nation’s GDP so it’s really nice to see it move into expansion territory.

What does it mean for business?

How is U.S. business dealing with increases in their supply chain costs? General Motors is a good example, announcing they have set a goal to cut back material and logistics costs by $1 billion by 2016.

GM hopes to improve its profit margin by 1 percent as a result of these efforts. They hope to achieve these savings by adding rail lines into plants, adding stamping plants within assembly operations that don’t have them, and by influencing parts suppliers to locate closer to plants.

With rising logistics costs, GM is planning aggressive improvements in the flow of its materials to stem the higher cost of transportation while driving efficiency. This is a lesson many companies can take to heart.

Transportation news

In transportation, a new Cass Frieght Index is out. This measure of shipment activity across several modes of transportation declined 3.1 percent in July year over year. It also showed a month-to-month decline in shipments from June to July.

A continuing decline in railcar loadings (falling 3.6 percent) drove the lower numbers. Intermodal shipments fell 2.5 percent. Truckload shipments were impacted due to capacity challenges.

A continuing decline in railcar loadings (falling 3.6 percent) drove the lower numbers. Intermodal shipments fell 2.5 percent. Truckload shipments were impacted due to capacity challenges.

Speaking of capacity issues, the new Hours-of-Service rules took effect July 1. A recent court battle with the Federal Motor Carrier Safety Administration has reached the conclusion that the 34-Hour restart provision will apply to all drivers except short-haul drivers.

Short-haul drivers are defined as those who operate exclusively within a 100-air-mile radius of their normal reporting location daily within 12 consecutive hours of reporting for duty. Also included are Non-Commercial Driver’s License drivers who operate exclusively within a 150-air-mile radius of their work reporting station. Technically it’s any driver who meets the conditions to qualify for a record of duty status or log book exemption (§395.1(e)) exempting them from the 30-minute rest break requirement.

Motor carrier earnings in the second quarter are a mixed bag, with most of the LTL carriers showing profits. The unionized carriers, ABFS and YRC particularly, have improved. ABFS settled a contract with the Teamsters and showed improvement and YRC realigned its network while showing modest improvement but coming in lower than expected. As reflected in the Cass index, LTL carriers saw modest to flat volume in their shipment numbers yet produced a 3 to 4 percent yield from pricing and improved operations. Expect continuing price increases from the LTL sector through this year and into 2014.

On the truckload side, Swift Transportation Co. has acquired privately held Central Refrigerated Transportation for $225 million. Central is the fifth-largest temperature-controlled truckload company (annual revenue of $504 million) in the U.S. so this is a significant acquisition for Swift, making it the second-largest temperature-controlled trucking company in the country.

Swift posted the largest profit gain of all publicly held truckload carriers in the second quarter, with net income rising 27.4 percent to $42.9 million from $33.7 million a year earlier. Heartland Express also did well in the second quarter.

The softening freight market for truckload carriers was reflected in lower second-quarter earnings at Werner, Forward Air, Knight, and Landstar. In general, truckload carriers would like an increase of 2 to 3 percent in pricing but are waiting for stronger freight demand before forcing the issue.

The Intermodal Association of North America's "Intermodal Market Trends & Statistics" quarterly report showed domestic container volume grew 9 percent in the second quarter year over year. Total intermodal traffic rose 2.4 percent in this period.

Volume from the international segment fell 1.3 percent in the second quarter after having grown 3 percent in the first quarter. A higher degree of transloading at West Coast ports, coupled with lower imports, impacted the number of international containers flowing into the U.S.

The Association of American Railroads reported intermodal traffic increased 4.8 percent for the week ending August 3 year over year. This was the highest weekly average for any July on record.

Carloads fell 0.4 percent for the week and declined 0.5 percent for the month of July.

In the “strange but true” category, UPS announced it was launching a pilot plan to install 3D Printers in six of its stores. UPS will allow customers to use their uPrint machines to produce spare parts or designs as an experiment to gauge customer interest in this technology.